Hawaii Target Date Retirement Funds Have Critical Flaws

Why Your Retirement May Not Be Secured After All

November 13, 2020 (Updated 6/22/2021) | Sage Capone

Target retirement date funds are usually found in defined contribution plans, primarily for 401(k)’s for Hawaii Employees.

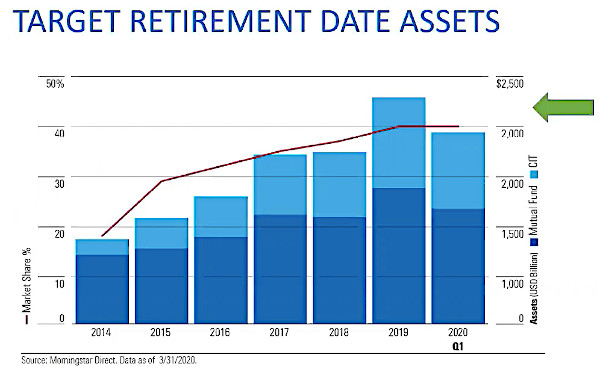

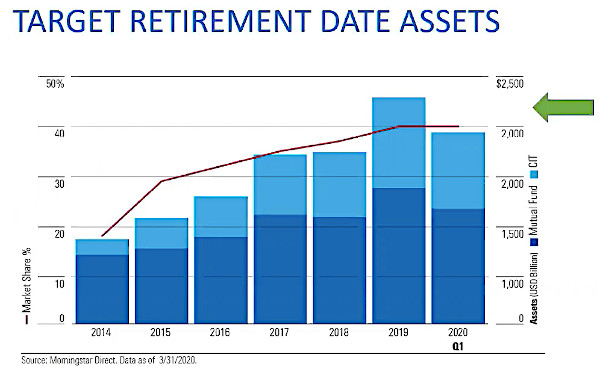

All the major fund Hawaii companies have their version and these funds currently hold more than 2 trillion dollars in retirement assets. But what makes them popular?

These funds aim to simplify an investors choice. Just select a fund with the year that is closest to your retirement year and the fund will make the asset allocation adjustments.

This market is dominated by many of the largest industry players. Each of these firms pick a selection of funds that reduces the allocation stocks as retirement nears.

So are they successful in providing for your Retirement?

These funds aim to simplify an investors choice. Just select a fund with the year that is closest to your retirement year and the fund will make the asset allocation adjustments.

This market is dominated by many of the largest industry players. Each of these firms pick a selection of funds that reduces the allocation stocks as retirement nears.

So are they successful in providing for your Retirement?

It is one thing to invest during a rising market, but it is quite another to make good decisions with your own retirement funds as you near or are in retirement during a bear market.

The second major flaw is that all these funds use what is called a glide path. Which basically shows, that is as the fund gets closer to the retirement date the percentage of equity’s reduces and is replaced with bonds.

The bonds begin to dominate the overall portfolio. Bonds are a part of a diversified portfolio, but the problem with the glide path is that it is forcing you to sell stocks and buy bonds right now at ultra-low interest rates.

The forward returns are linked directly to starting interest rates and there poised to be below average for years. These funds are making these allocations based on a formula developed in the early 1990s, when interest rates were 6 to 8%.

It is one thing to invest during a rising market, but it is quite another to make good decisions with your own retirement funds as you near or are in retirement during a bear market.

The second major flaw is that all these funds use what is called a glide path. Which basically shows, that is as the fund gets closer to the retirement date the percentage of equity’s reduces and is replaced with bonds.

The bonds begin to dominate the overall portfolio. Bonds are a part of a diversified portfolio, but the problem with the glide path is that it is forcing you to sell stocks and buy bonds right now at ultra-low interest rates.

The forward returns are linked directly to starting interest rates and there poised to be below average for years. These funds are making these allocations based on a formula developed in the early 1990s, when interest rates were 6 to 8%.

They’re not based on the value or outlook for the asset class in today’s world. Stocks trade at a forward price to earnings (PE) around 22.

Bonds on the other hand, when using the interest for earnings, trade at a forward PE ratio of 135.

A recent academic research paper, studied the all important question: Do Target Retirement Date Funds Underperform?

The results of the study show that target retirement date funds across the board show a negative alpha and under performance based on their analysis.

Target retirement date funds are better then not investing but as money accumulates in a retirement account a managed portfolio might be a better fit.

They’re not based on the value or outlook for the asset class in today’s world. Stocks trade at a forward price to earnings (PE) around 22.

Bonds on the other hand, when using the interest for earnings, trade at a forward PE ratio of 135.

A recent academic research paper, studied the all important question: Do Target Retirement Date Funds Underperform?

The results of the study show that target retirement date funds across the board show a negative alpha and under performance based on their analysis.

Target retirement date funds are better then not investing but as money accumulates in a retirement account a managed portfolio might be a better fit.

These funds aim to simplify an investors choice. Just select a fund with the year that is closest to your retirement year and the fund will make the asset allocation adjustments.

This market is dominated by many of the largest industry players. Each of these firms pick a selection of funds that reduces the allocation stocks as retirement nears.

So are they successful in providing for your Retirement?

These funds aim to simplify an investors choice. Just select a fund with the year that is closest to your retirement year and the fund will make the asset allocation adjustments.

This market is dominated by many of the largest industry players. Each of these firms pick a selection of funds that reduces the allocation stocks as retirement nears.

So are they successful in providing for your Retirement?

The 2 Issues That Make Your Retirement Funds Fall Short

However, the underlying assumptions these funds make, have two critical flaws. The first assumption is that investors would be passive and ride the ups and downs with the funds. Through analysis at fund flows, shows massive outflows in the march sell-off, earlier this year. Investors as far as 15 years from retirement, pulled money from the market. It is one thing to invest during a rising market, but it is quite another to make good decisions with your own retirement funds as you near or are in retirement during a bear market.

The second major flaw is that all these funds use what is called a glide path. Which basically shows, that is as the fund gets closer to the retirement date the percentage of equity’s reduces and is replaced with bonds.

The bonds begin to dominate the overall portfolio. Bonds are a part of a diversified portfolio, but the problem with the glide path is that it is forcing you to sell stocks and buy bonds right now at ultra-low interest rates.

The forward returns are linked directly to starting interest rates and there poised to be below average for years. These funds are making these allocations based on a formula developed in the early 1990s, when interest rates were 6 to 8%.

It is one thing to invest during a rising market, but it is quite another to make good decisions with your own retirement funds as you near or are in retirement during a bear market.

The second major flaw is that all these funds use what is called a glide path. Which basically shows, that is as the fund gets closer to the retirement date the percentage of equity’s reduces and is replaced with bonds.

The bonds begin to dominate the overall portfolio. Bonds are a part of a diversified portfolio, but the problem with the glide path is that it is forcing you to sell stocks and buy bonds right now at ultra-low interest rates.

The forward returns are linked directly to starting interest rates and there poised to be below average for years. These funds are making these allocations based on a formula developed in the early 1990s, when interest rates were 6 to 8%.

They’re not based on the value or outlook for the asset class in today’s world. Stocks trade at a forward price to earnings (PE) around 22.

Bonds on the other hand, when using the interest for earnings, trade at a forward PE ratio of 135.

A recent academic research paper, studied the all important question: Do Target Retirement Date Funds Underperform?

The results of the study show that target retirement date funds across the board show a negative alpha and under performance based on their analysis.

Target retirement date funds are better then not investing but as money accumulates in a retirement account a managed portfolio might be a better fit.

They’re not based on the value or outlook for the asset class in today’s world. Stocks trade at a forward price to earnings (PE) around 22.

Bonds on the other hand, when using the interest for earnings, trade at a forward PE ratio of 135.

A recent academic research paper, studied the all important question: Do Target Retirement Date Funds Underperform?

The results of the study show that target retirement date funds across the board show a negative alpha and under performance based on their analysis.

Target retirement date funds are better then not investing but as money accumulates in a retirement account a managed portfolio might be a better fit.